Tag Archives: Medicare

Features Of The Best Medicare Advantage Plans 2021 In The Market

Medicare is The health care plan supplied from the federal authorities of the United States of America. Medicare advantage plan could be that the alternative for the Medicare licensed by Medicare developed for the older citizens of their USA. This course of action gives extra coverage which covers the bills not included in Medicare. It’s uncomplicated and meets all of expenses of all these elderly citizens.

To qualify for a Medicare advantage program, you have to have Original Medicare which covers Part One and Part B but perhaps not the hospital coinsurance. Here are some of the Best Medicare Advantage plans 2021· Standard Medicare Advantage: this Handles the medication prescription. It will not overlap using the Medicare program. But, it’s not handy for people that signed up for Medicare Part D that covers the price of medicines.

· Medicare Advantage Part D: this plan carries a good deal of advantages because it insures several aspects of health care for example dental appointments and cleaning, vision, hearing, and annual professional medical appointments along with the general awareness apps.

In addition, it covers the prescription for fresh glasses and hearing aids that may normally cost a penny. It also covers prescription drugs.

Does Medicare advantage programs work nicely using the other insurance policies?

As Mentioned before, the advantages plans are compatible with the original Medicare plan. But it might perhaps not be compatible with additional insurance plans like the people provided from the trade unions or other companies.

It might Also battle with all the Medigap or supplement plans. Thus make your choice carefully.

Get TheBest Medicare Supplement Plans 2020

If one reaches the golden age of 65, an individual would be looking in the different medical insurance plans. One can find that the Medicare Original Plan, but it might be unable to cover all the facilities which one requires. Within this instance, an individual would need to check farther and watch that the various supplement plans provided by private companies. Inside this circumstance, an individual might perhaps not know that which plan might do the job well for you. Thus, just how can one figure out what medicare supplement plans include silver sneakers?

Just how do one select a Medicare Supplement program?

• Since every program has its strength and weaknesses, one should investigate the providers provided by each and every strategy. Primarily, one ought to reevaluate the service that one requirements and see if the plan has it. Depending on what you require, one may decide on the master plan that has got the optimal/optimally coverage for you personally.

• The options include distinctive rates. A related plan provided by two companies can have a gap in prices, so a single re-search it out attentively to find the plan with the very best cost.

• Health supplement plans might be significant on the pocket, so therefore one should make sure one is perhaps not paying services which one will not utilize. An individual should assess the prices and the services offered from the plan to find which program suits you.

• One ought to look outside for areas where you will receive reductions. Nutritional supplements are offered by diverse individual businesses. One could enquire about the availability of special discounts. This can help you in keeping a little funds.

• One needs to consider your trip history. Are you someone who travels alot, or do you hardly leave your property? This can be an significant factor whilst choosing policy.

The best Medicare supplement plans 2020 would be the ideas that function nicely along with your funding when covering for many of the necessities. Hence, an individual should spend their period in researching out the coverage plan that works best with your lifestyle.

Hosting the right use of Medicare supplement plans 2020

Medicare Supplement plans have certain”Guaranteed Issue” durations that allow people to submit an application for an agenda without even mentioning that you coverage, aside from your pre existing conditions, or charging you extra due to any health circumstances. These guaranteed difficulties (GI) legal rights are Federally-mandated through the Centers for Medicare & Medicaid Services and see for you all Medicare-enrolees who are in one of these exceptional requirements on Medicare supplement plans 2020.

Employing the right can assist you

The GI Rights usually occur while your cutting-edge healthcare insurance is changing undoubtedly or you’re involuntarily losing your own coverage.

Specific policy businesses can likewise create their GI requirements, and they’re doing however, you can find seven Federally-prescribed GI circumstances that each Medicare Supplement insurance plan organizations should adhere to. If you encounter one of these phases, then you should be able to join up for a Medicare Supplement intend on a Guaranteed Issue foundation. These seven states are around on Medicare supplement plans 2020:

What is your simple pointer?

1. You Have a business enterprise or union insurance that’ll cover soon after Medicare, and that insurance plan is currently all finishing.

2. You Are enrolled in a Medicare Advantage plan, and this particular plan is leaving the Medicare applications, quits servicing your vicinity, OR you’re changing from the program’s particular service area.

3. Now you Really have a Medicare decide on policy, also you’re moving out of this program’s carrier area. You are able to conserve your cutting policy, but you have the proper, on a GI foundation, to exchange to brand new policy.

4. Your Medicare Supplement company goes bankrupt, which motives you reduce your coverage. OR, you get rid of Medicare Supplement program coverage without a matter your very own.

Last thoughts

In the Event You have Enrolled in a Medicare Advantage program or speed whilst you have been eligible to register up, and over just a year of linking, you prefer to switch back into”specific” Medicare (along with a Medicare Supplement approach ).

Does it matter which company I am choosing for my Medicare Supplement plan?

In the Majority of the developed countries, An initial Medicare strategy is offered for the public which helps them to keep the higher price tag of health care facilities, but this plan of action sometimes is not sufficient enough to give comprehensive relief as it may not cover a number of the centers below it. Thus, because of this some additional plans like Medicare Supplement Plan G are introduced so that plan G Medicare addresses the places that are left in the in the original Medicare plan.

Best Medicare Complement plan

Immediately after observing Each of the programs, There are certain points inside the Medicare plan G that makes it the very best plan among all others. The first thing is the fact that Plan G Medicare allows really small yearly amount that has to be compensated as high for its benefits. Second program G covers much of those places that other strategies the first Medicare program covers. In addition, it pays smaller amounts even contained the hospice prices, copayments, nursing charges and also help in the inpatient and outpatient charges, that have to get paid. It offers all of these wonderful gains in a very small price which has to be paid annually. It bears a lot of the out of pocket prices that original Medicare leaves offered you to. Using Plan G Medicare , you now just have to pay for the cost tag on allowance of Medicare supplement strategy B, which is roughly 198percent in 20 20. So due to those reasons aim G is still thought of as absolutely the absolute most costeffective program.

Medicare part G and how it is standardized

Introduction

Medicare supplement Plans for example part gram are typical standardized. This means it will not issue the provider which you choose as the huge benefits will likely remain the same. It’s possible to shop around to find your optimal/optimally insurance company but be sure that your Medicare part G will probably be standardized in these manners.

Benefits

The Very First manner through That Medicare part G coverageis standardized is by means of equal added benefits. This indicates that you do not have to be worried which one company can provide many benefits as compared to other. This means every one registering for Medicare dietary supplement portion G has identical added benefits and health care rights.

Medical Practioners network

Additionally, this Is another Item that is standardized once you combine Medicare supplement Plan G. Medicare Part G coverage insurance plan businesses don’t need their special doctors. That’s because their own Medicare strategies are supplements to initial Medicare program A and plan B. Thereforeyour doctor’s network is going to soon be the national large Medicare network. This indicates that you do not have to worry whether the business that you are choosing has better doctors or never.

The claims-paying Process

Additionally, this Is a different Thing which may remain standardized. The Medicare declare approach is obviously automatic. It is possible to easily utilize the policy without visiting all types of paperwork. Once your claim is accepted, your percentage is going to likely be paid off and subsequently your company will likely be informed. The business will subsequently cover the necessary amount as per the directions. Due to the standardized procedure, each and every provider is the same from the claim-paying approach together with maintain history.

Cover The Gaps In Medicare With Medicare Part G

Medicare G is great for that child boomer audience. It is very much like part F and that’s why it is popular combined with F. This plan is fantastic for people comfortable playing a modest fee annually. Not just this insures the gaps in your medicare and also pays coinsurance, copays, and deductibles. One can get an array of benefits if they choose to acquire the Medicare Plan G.

About medicare part G

Also known as Medigap strategy G, is really a Versatile strategy for people who want excessive coverage compared to their original program. As stated by the plan, it will cover all the openings within the original medicare program. But, one particular thing that is not insured under this plan of action is that the health care deductible (component B deductible).

This component will probably insure Services like proficient nursing, and blood transfusion, hospice care, etc.. Along with some outpatient care such as ambulance, physician visits, xrays, lab works, etc.. As soon as the medicare advantages get exhausted, the medicare plan G rewards begin.

Rewards under medicare part G

• Part A Hospice care (co payment and coinsurance)

• Role A Hospital expenses and co-insurance (around one year following the original plan’s rewards gets in excess of )

• Element B insurance Of preventive treatment

• Role B copayment or coinsurance

• Overseas Travel emergency upward to 80 percentage

• Blood upward to 3 pints

• Role A Interest

• Role B Extra prices

• Qualified Nursing facility

Picking out medicare part G

One can Select this strategy in any Carrier, as the maintenance and benefits are all typical standardized. The advantages supplied by all providers are all the same. Also, the physician’s system isn’t specified below this nutritional supplement. One may head to some other physician who happens under the medicare community. Along with all this, the more claims approach is virtually identical among those providers.

Final words

Medicare G Is Ideal for Anyone who Want a little additional coverage to their own part A & B. However, the secret is to find the plan may be the full time within the first a few months prior to getting the unique medicare component B. It’s best to speak with the providers and get the essential policy-related information prior to using any decision.

Medicare Supplement Plans 2021: Choose the Right Plans!

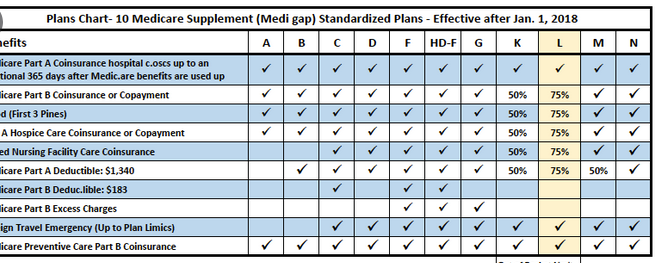

Wellness insurance can be just a security that someone can present yourself. It’s helpful to this individual in so many manners because it gives individuals who have a confidence which will manage their health together with their own finance. As you reaches the golden era of being a mature citizen, then you gets got the benefit of the wisdom obtained with practical experience and the capability to be able to access the Medicare supplement plans comparison chart 2021 to successfully use it in order to its own benefit.

Points to Stay in Mind Prior to employing for Nutritional supplements:

• To be able to experience the benefits of the Supplement plans, 1 wants to own Medicare Part A or Part B. These will be the first plans and the nutritional supplement plans act being a accompaniment to these programs. The nutritional supplement plans are discretionary to your patient, however component A or Part B is compulsory in case a person desires extra programs.

• In order be able to use those plans, You Need to Pay a premium to this organization which you has taken the strategies out of. This premium paid to your supplement plans is different from the premium which you pays for Part A or Part B. Thus, you’re paying to distinct rates for the those services.

• These ideas are more limited to an agenda every single person. The master plan would not insure your family or your own spouse. If the elderly individuals want the insurance, then they have to individually sign up for it.

• One can Locate These programs from some of these Insurance company that sells these programs. An individual needs to remember that it should really be licensed into the region and know they cannot cancel plans together with you in the event you cover a premium.

In case One wants additional coverage and another set of protection for your own wellness, an individual can choose in the selection of Medicare supplement plans 2021and also live a healthful and prosperous existence.

Here is why health plans are important these days

Medical-related issues Are Rising Accendo Medicare Supplement plans from the world, Thanks to technology, treatment on a lot of the diseases are available on earth. However, everybody else cannot afford those costly treatment options; therefore, people look for Accendo Medicare supplement plan G. These ideas will insure your important health requirements. We are going to discuss all these wellness options.

Convenient coverage alternatives

All these Wellness programs are very flexible; You May personalize These health plans as per your requirements. All these health plans were created considering rising diseases on earth. The long run health requirements of these users are insured by these needs. Even if you are afflicted by chronic diseases, you can become a member of these plans and fight these diseases by using the vast system of physicians and hospitals of these programs. They have been providing medical care insurance into those members.

The participants may ask some additional features from Those wellness programs, even in the event that you are suffering from a particular disorder that isn’t insured by these health plans, ask them to put in it in your deal and receive medications and clinical tests for this disorder. The medication policy is likewise offered to your sufferers, however, the drugs prescribed with the affiliated physicians are coated by these ideas.

A blessing for elderly citizens

These health programs are a blessing to its aged citizens, While the possibility of illnesses increases in the latter region of the life in the event that you sign up for all these medical programs, then that you won’t need to be anxious regarding the financing of one’s medical bills. Senior taxpayers may save major amounts by enrolling up for all these wellness programs. You can find some wellness plans which likewise offer policy to your own lab evaluations to these end users.

In Summary, these health programs Are Extremely important these Days for the users to cover their medical requirements, start looking to find the best insurance service in your town, and also live a stress-free life.

Medicaid Vs Medicare Advantage Plans For 2021

The word Medicare is Something Which Is Medicare advantage plans 2021 qualified by The majority of these Americans. An individual could think about the word Medicare being a kind of health insurance policy policy that’s presented for the people that comes below the classification of those elderly citizens. It is a program that subdivides the healthcare solutions. They provide their providers to a number of those with selected diseases. The Medicare advantage plans at 2021 are divided in to different strategies that cover a wide range of health scenarios. It is actually a national application that lets the services with the specific eligibility requirements.

Types of those Medicare coverage

There are four Unique kinds of all medicare apps That are available to all people. The most elementary type of coverage starts out from the medicare A and part B also called as the Original medicare and even by way of the medicare section C the individuals could get registration for the medicare part D. The important points of a part are as follows:

Medicare part A handles the costs of the statements which can be manufactured by the hospitals or by the nursing facility. This kind of policy is beneficial who gets social security benefits.

Medicare part B covers the costs for things like the upkeep of the outpatient such as for example the range of visits created by a doctor. Along with this it even covers the preventative services. The ambulatory services plus a few of the drugs gear.

Medicare component C which is known by the title of Medicare gain options 2021 provides the policy that is equivalent to this original medication.

Medicare portion D provides the different types of supplement prescriptions that are needed by the individual.

So, just one going through the medicare Healthcare should consult with all the important details associated with this.

https://www.ehealthmedicare.com/about-medicare-articles/facts-about-medicare/

https://www.medicaremadeclear.com/basics/medicare-vs-medicaid

Choose The Best Plans - Compare Medicare Supplement Plans

Medicare Nutritional supplements are Compare Medicare Supplement plans healthcare plans that offer coverage into the policy-holders on their health and health care expenses. These supplement options are far more beneficial once you find them from the perspective of the plan holders.

Health Care strategies are important you can feel as though you or even a relative may need financial aid together with their medi cal Bill’s. But whenever you opt for a Medicare or any other health care program, you will run into assorted kinds of coverages and also also make policy sellers. You should Evaluate Medicare Supplement programs along with different healthcare insurance policies before you obtain one so that you can take advantage of one’s purchase.

This Comparison is quite a simple approach. Check out the Subsequent things to see what works better for you personally –

Insurance Claim process

In case You are planning in purchasing a health insurance policy policy, you always have to understand the claim process is simple and perhaps not overly challenging. Complications can cause mistakes in the assortment of the perfect program. You ought to assess to get a nice and helpful customer service team.

Proper Insurance Policy Amount

When You examine Medicare Supplement strategies or any other health insurance plans, so make sure that you check the insurance policy quantity and the superior rates. You must be aware of the ongoing rates on the industry so that you do not drop for fraudulent schemes and end up losing your own cash. Make certain the superior fees are cheap and also you aren’t in a disadvantage. Make sure the services that will be provided match up with the fee you bear.

Medi Cal Check for-free

Most Of the Medicare strategies supply free medical checkups and doctor visits. This will likewise not impact the speed should superior throughout the renewal of this coverage.

Now you Can come across comparison graphs on the web. Make sure to do your research when choosing a healthcare insurance policy policy.

https://www.medicare.gov/supplements-other-insurance/whats-medicare-supplement-insurance-medigap

https://www.medicare.gov/sign-up-change-plans/different-types-of-medicare-health-plans

https://www.medicare.gov/supplements-other-insurance